A Third Party Administrator (TPA) performs an important job in various sectors, notably in overall health coverage, where by they work as intermediaries among insurance coverage providers and policyholders. But what precisely is often a TPA? Fundamentally, a TPA is undoubtedly an entity that manages administrative tasks connected to insurance plan claims and benefits on behalf of insurance plan organizations. This outsourcing allows insurance plan providers to aim a lot more on Main functions like underwriting and coverage administration whilst entrusting administrative procedures to specialised third functions.

TPAs deal with A selection of responsibilities, principally centered about processing statements competently and precisely. Their responsibilities include verifying claim validity, analyzing protection eligibility, and processing payments to healthcare companies. By streamlining these jobs, TPAs help minimize administrative burdens for insurers, guaranteeing more rapidly resolution of claims and improved client satisfaction.

Within the context of wellness insurance policies, TPAs are pivotal in handling wellbeing benefits for policyholders. They act as liaisons in between insurers, healthcare companies, and insured folks, making certain easy conversation and productive processing of health care statements. This position is particularly vital in running intricate healthcare billing processes and navigating regulatory specifications.

The necessity of a TPA while in the Health care sector can't be overstated. They supply knowledge in statements administration, assisting to Regulate costs by negotiating favorable charges with Health care vendors. In addition, TPAs greatly enhance transparency Tpa In Health Insurance by supplying in depth reviews on promises processing and expenditure, enabling Best TPA insurers to help make informed selections about coverage and pricing.

Selecting a trustworthy TPA is paramount for insurance firms hunting to maintain significant specifications of service shipping. Trusted TPAs exhibit trustworthiness in claims processing, adherence to regulatory expectations, and strong customer support. This trustworthiness is essential in retaining insurer-consumer interactions and upholding the track record of insurance plan providers in competitive markets.

For corporations and insurers seeking regional TPA products and services, things to consider often involve familiarity with regional healthcare suppliers, expertise in local regulatory frameworks, and responsiveness to localized client demands. Neighborhood TPAs can provide customized provider and more quickly reaction times, that are advantageous in handling regional insurance policy functions efficiently.

In states like Minnesota and Michigan, TPAs cater to certain regional demands and rules governing insurance policies operations. Neighborhood TPAs in these regions are very well-versed in state-certain rules and laws, ensuring compliance and seamless integration with area Health care networks.

The most beneficial TPAs distinguish them selves as a result of a mix of effectiveness, trustworthiness, and purchaser-centric company. Coverage vendors normally Consider TPAs based mostly on their own reputation in promises management, shopper fulfillment scores, and technological capabilities. These things contribute to selecting a TPA that aligns Along with the insurer's operational plans and boosts All round support supply.

In conclusion, TPAs Enjoy a vital job during the insurance policies ecosystem, specifically in controlling administrative functions and maximizing company performance. Their responsibilities span across several sectors, having a Principal focus on healthcare in which they aid seamless promises processing and gain management. Selecting the proper TPA includes concerns of dependability, skills, and alignment with neighborhood regulatory specifications, making certain exceptional support shipping and delivery and client pleasure in insurance plan functions.

Melissa Joan Hart Then & Now!

Melissa Joan Hart Then & Now! Matilda Ledger Then & Now!

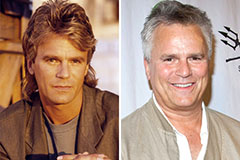

Matilda Ledger Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now! McKayla Maroney Then & Now!

McKayla Maroney Then & Now! Naomi Grossman Then & Now!

Naomi Grossman Then & Now!